.png?sfvrsn=92fdee60_1)

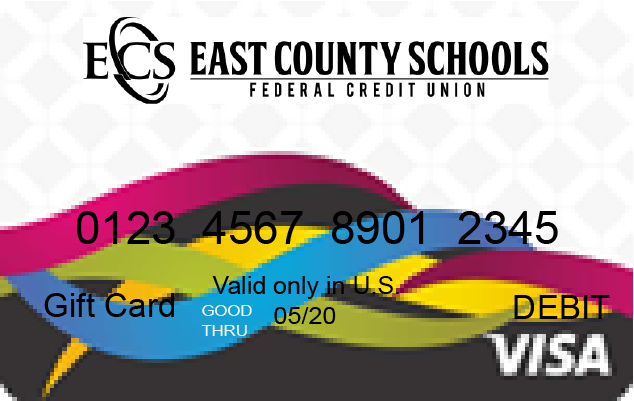

ECSFCU!

ECSFCU!

ECSFCU is big enough to approve loans with great rates and small enough to provide personal service and products that are important to the educational community.Randy Montesanto Grossmont Union High School District

Rates as low as 4.70%APR for new or 4.90%APR pre-owned ECSFCU auto loan!

APR=Annual Percentage Rate. Effective 03/01/2024