.png?sfvrsn=92fdee60_1)

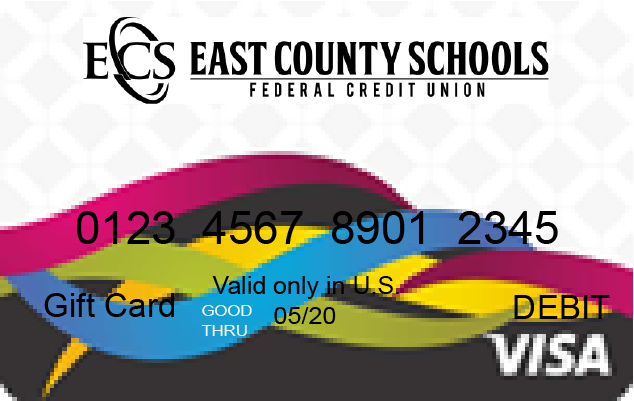

ECSFCU!

ECSFCU!

I've bought three cars through the credit union. They make it very easy, very simple, and you can't beat the interest rate. I highly endorse them, their friendly staff, and the service that East County Schools gives its members!Karl Danielson Granite Hills HS Television, Film and Digital Media Teacher

Rates as low as 4.70%APR for new or 4.90%APR pre-owned ECSFCU auto loan!

APR=Annual Percentage Rate. Effective 03/01/2024