.png?sfvrsn=92fdee60_1)

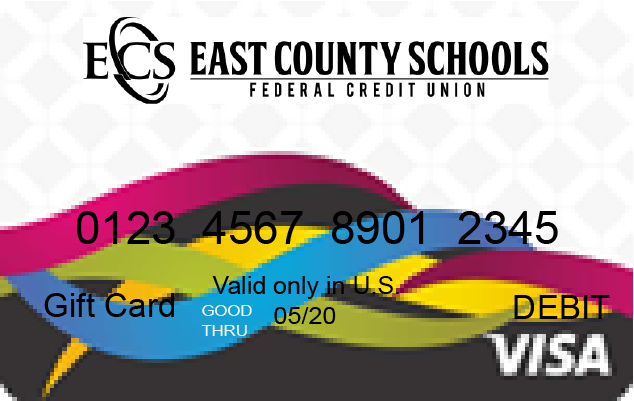

ECSFCU!

ECSFCU!

We bank with East County Schools Federal Credit Union and learned they also have a great car buying service! We decided to look into it and ended up with the best customer service, an amazing price, no hassle of going to the dealership, and a brand new 2017 Honda Accord Sport! A year later, we were in need of another car for our growing family. It was an easy decision to go with the credit union and New Cars Inc again. The process and customer service didn’t disappoint once again, and we love our new 2018 Honda CRV! A big thank you to New Cars Inc and ECSFCU!Carly and Luke Esquerra

Rates as low as 4.70%APR for new or 4.90%APR pre-owned ECSFCU auto loan!

APR=Annual Percentage Rate. Effective 03/01/2024