.png?sfvrsn=92fdee60_1)

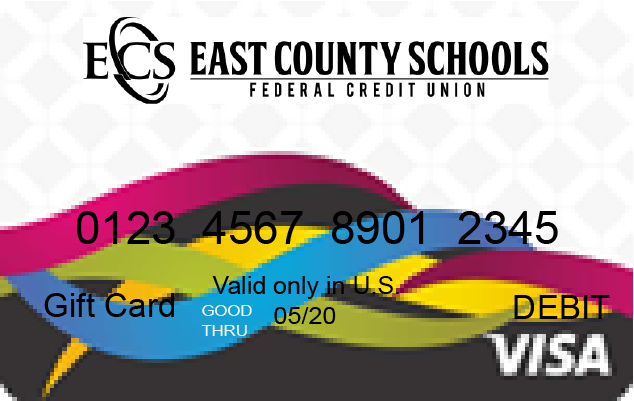

ECSFCU!

ECSFCU!

Grant Nelson - Retired La Mesa Spring Valley Schools 8th Grade History TeacherWhen I became an ECSFCU member, I immediately refinanced my house and got better rates for two cars. East County School employees who are just starting out, this is the best place to be! ECSFCU can help you secure your financial life.

Rates as low as 4.70%APR for new or 4.90%APR pre-owned ECSFCU auto loan!

APR=Annual Percentage Rate. Effective 03/01/2024