.png?sfvrsn=92fdee60_1)

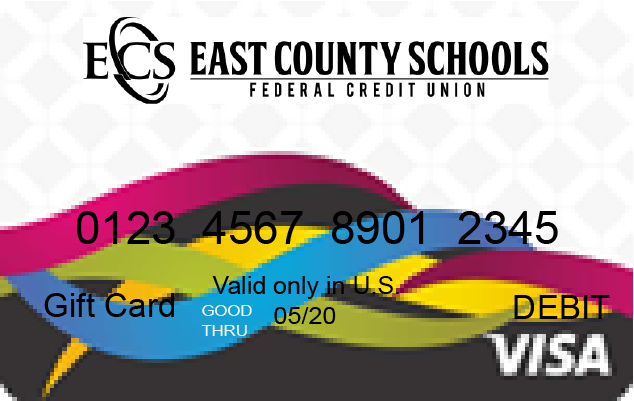

ECSFCU!

ECSFCU!

Jack Charles, Grossmont High School District, retiredMy Loan Officer, Mireya, is truly an asset to ECSFCU. She is competent, articulate, sweet and compassionate. When there was an error in the payoff of my car, Mireya personally took a credit union check and drove it to the dealer to correct it, the same day. We are thankful for the time and effort she put into this important transaction. That’s customer service, and she is leading the pack!

Rates as low as 4.70%APR for new or 4.90%APR pre-owned ECSFCU auto loan!

APR=Annual Percentage Rate. Effective 03/01/2024